Germany’s Battery Storage Tsunami: Will We Sink or Swim?

Picture: AI generated picture of the world hit by a battery tsunami.

“I’m both excited and concerned when I think about the future of large-scale energy storage in Germany and Europe. Massive potential, massive challenges. A ‘battery tsunami’ is on the horizon, some say; we should be prepared to ride the wave, but we aren’t. We are consumed in norming, planning, talking. I see parallels to PV some years ago…” says Claudius Jehle, CEO of volytica diagnostics.

Germany’s Energy Storage Ambitions: Bridging the Gap Between Vision and Reality

The large-scale energy storage market in Germany is on the verge of significant expansion. With 161 GW of battery storage systems currently in the process of approval, the market’s growth trajectory is undeniable. However, when compared to the Federal Network Agency’s projection of just 23.7 GW by 2037 and the mere 1.5 GW implemented so far, it becomes clear: ambition alone is not enough. Effective planning, robust operational strategies, and scalable solutions are essential to turning this vision into reality. As Der Spiegel recently highlighted in an article on the subject, this “battery tsunami” requires immediate action to align these plans with realistic pathways and infrastructure (Der Spiegel).

Keeping Value Creation in Europe

One of the key priorities for the energy storage sector must be to retain and grow value creation within Europe. While capacity expansion is vital for the energy transition, operations and maintenance are equally critical—and often overlooked. These areas not only represent significant economic and technological opportunities but also play a central role in ensuring system reliability and safety.

China is investing €750 million in energy storage research and development, while the U.S. is allocating €16 billion to expand production and recycling capabilities. In comparison, the EU remains underfunded and uncoordinated. If Europe has already missed its opportunity to lead in battery cell production, it must now focus on dominating adjacent areas such as operations, monitoring, and recycling (springerprofessional.de).

Status Quo in Germany

Source: Fraunhofer ISI

Examining industry developments in Germany reveals both opportunities and challenges:

The relatively stable legal and regulatory framework in Germany supports long-term investment planning, providing investors with the confidence needed to commit to BESS projects. The Government’s energy storage strategy, published in late 2023, aims to support the expansion dynamics of energy storage systems, further strengthening the market’s appeal. This strategy represents an important first step in officially defining the role of large battery storage systems in Germany’s energy transition (BMWK).

Yet, regional disparities in infrastructure costs threaten to slow the expansion of energy storage. For example, connecting a 100 MW storage system can cost up to €14 million in southern Germany, compared to just €5 million in the north. Such discrepancies risk placing storage systems in suboptimal locations, undermining their effectiveness in stabilizing the energy grid (landverpachten.de).

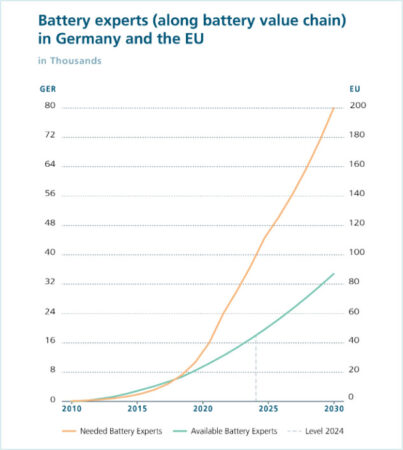

Addressing the Skills Gap in Germany

Germany’s energy transition faces another critical challenge: a significant shortage of skilled battery professionals. By 2030, Europe will need 100,000 additional battery experts to meet growing demand. Compounding this issue is the upcoming 30% reduction in research funding, amounting to €1 billion, by 2025. Without targeted efforts in education and training, the industry risks stalling due to a lack of expertise (Fraunhofer Institute for Systems and Innovation Research ISI).

This skills gap has a direct impact on the safe and reliable operation of energy storage systems. In response, the demand for automation and digital solutions is increasing.

Understanding the “blackbox”

Batteries are among the most complex degrading components of the energy transition: With over one billion possible material combinations within the lithium-ion familyx, managing these systems poses significant challenges. Further, a Battery Energy Storage System (BESS) produces 100 times more sensor data than PV modules, much of which goes underutilized.

At the BVES Jahrestagung on November 28th in Berlin, a decision was announced that could have far-reaching implications for the whole industry. Despite the growing complexity of battery systems and the increasing reliance on large-scale energy storage, the working group “Digitalization & Battery Safety” opted to explicitly exclude centralized battery monitoring as a risk mitigating factor in their upcoming battery safety guideline.

Claudius Jehle, CEO of volytica diagnostics, on this:

“We regret the decision. We agree that ‘conservative’ methods like spacing between containers, fire extinguishing systems and the reliance on the local electronics (Battery Management Systems, BMS) is vital, inevitable and builds the foundation of a multi-layered safety net. But why exclude predictive tools? We see that German-built batteries are safe, but let’s face it: The ‘tsunami’ will be composed of systems from the Far East, and we cannot rely on them to adhere to our standards, norms and regulations per se.”

The reliance on Battery Management Systems (BMS) alone, while common, is often insufficient for the realities of modern battery systems – as it is for other complex assets. Every wind turbine, gas turbine or PV park is monitored in a centralized monitoring system today. The BMS ensures basic safety within predefined parameters but particularly non-high-end systems lack the capacity for cross-module data comparison, self-learning, tracking of long-term trends, or evaluating chemistry-based performance variations. All things that centralized predictive analysis can provide at little additional costs.

This distinction is particularly important in a market where over 90% of batteries are produced under unclear standards and regulations, often leading to system failures even at the BMS level. Jehle added, “Even high-quality European-manufactured batteries can benefit from monitoring as an addon, but for the majority of assets, we just think it’s not an addon: It’s a must, and it will become mandatory.”

With €2 billion worth of batteries unnecessarily replaced across the EU each year due to insufficient health monitoring, the need for active, independent oversight will keep growing. It not only ensures safety and reliability but also maximizes battery value and life cycle potential.

Harnessing the upwind

Germany and Europe must act decisively to seize the opportunities in the energy storage sector. This includes targeted funding, reducing costs, and making significant investments in workforce development. Without these measures, Germany risks falling behind in the global race, even as promising projects emerge across the country.

The energy storage “tsunami” is here — but it will take bold decisions and innovative digital solutions to turn this upwind into a lasting success story for Germany and Europe.

We are curious about your experiences with BMS versus battery monitoring. Do you share our concerns about over-reliance on conventional approaches, or have you encountered challenges in ensuring battery reliability and safety? Get in touch to exchange insights and explore how we can tackle these issues together, paving the way for a sustainable and efficient energy storage future.

Please use the contact form or send us a direct message to contact@volytica.com. We look forward to hearing from you!